Let’s say you take a generic blood pressure pill every day. It costs $10 per prescription. You’ve paid $300 in copays this year already. You might think, "I’m getting closer to meeting my $1,500 deductible." But here’s the truth: those $10 copays don’t count toward your deductible. They do count toward your out-of-pocket maximum. And that difference? It can save your wallet-or wreck your budget if you don’t know it.

What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you pay before your insurance starts sharing the cost of most services. For example, if your deductible is $2,000, you pay the full cost of doctor visits, lab tests, and prescriptions (unless they’re preventive) until you’ve spent $2,000. Then your plan kicks in with coinsurance-say, you pay 20%, insurance pays 80%.

Your out-of-pocket maximum is the total amount you’ll pay in a year for covered services. Once you hit that number, your insurance pays 100% of everything else for the rest of the year. For 2026, the federal cap is $10,600 for an individual and $21,200 for a family on Marketplace plans.

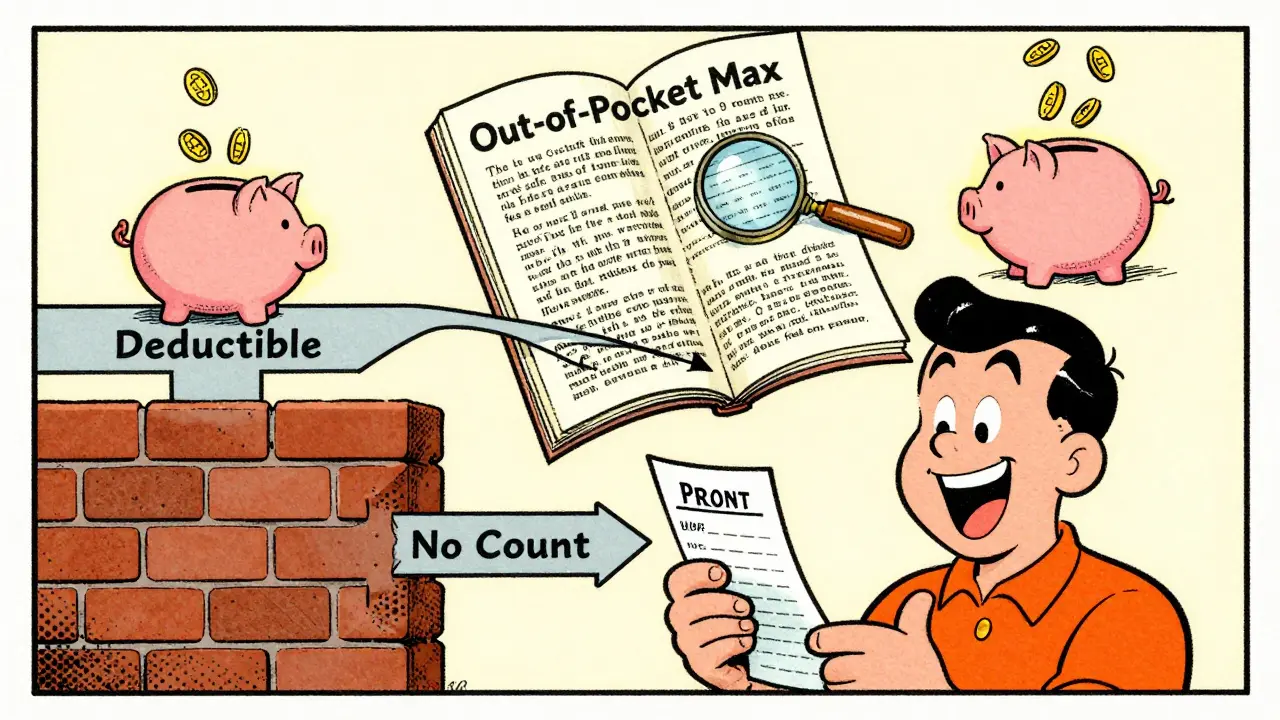

Here’s the key: Everything you pay out of pocket for covered services-deductibles, coinsurance, and copays-counts toward that out-of-pocket maximum. But only your deductible payments count toward your deductible. Copays? They’re a separate track.

Why don’t generic copays count toward your deductible?

This isn’t a glitch. It’s by design. Before 2014, many plans didn’t even have out-of-pocket maximums. People with chronic conditions-diabetes, asthma, high blood pressure-could spend thousands on prescriptions without ever getting relief from their insurance. The Affordable Care Act fixed that by requiring all plans to include an out-of-pocket maximum. But it left the deductible system intact.

So now, you have two separate counters:

- Deductible counter: Only counts what you pay for services before your plan starts sharing costs. For prescriptions, that’s usually only if you have a separate prescription deductible.

- Out-of-pocket maximum counter: Counts everything: your deductible payments, your coinsurance, and your copays-including generic drug copays.

That means if you pay $10 for a generic prescription, that $10 goes straight into your out-of-pocket maximum total. But it doesn’t move the needle on your deductible. You could pay $5,000 in copays over the year and still owe your full $2,000 deductible on your next hospital visit.

How do different plan types handle this?

Not all plans are built the same. There are three main ways prescription costs are structured:

- Single deductible (27% of plans): One deductible covers both medical and prescription costs. If you pay $15 for a generic drug, that $15 counts toward your single deductible. Once you hit it, you pay coinsurance on everything.

- Separate medical and prescription deductibles (37% of plans): You have two deductibles. One for doctor visits and hospital stays. Another just for prescriptions. You pay full price for meds until you meet the prescription deductible. After that, you pay copays that count toward your out-of-pocket maximum-but not your medical deductible.

- Copay-only with no prescription deductible (36% of plans): No prescription deductible at all. You pay your $10 copay every time you fill a generic. Those copays count toward your out-of-pocket maximum, but not toward your medical deductible.

Most people assume their plan is #1. But if you’ve got a separate prescription deductible, you’re paying full price for meds until you hit that second deductible. That’s where people get blindsided.

Real people, real confusion

One user on HealthCare.gov wrote: "I paid $10 for my insulin every month for 10 months. That’s $1,000. I thought I was halfway to my $2,000 deductible. Turns out I still owed the full $2,000. I didn’t even know I had a separate prescription deductible."

That’s not rare. A 2023 survey found 68% of consumers think prescription copays count toward their deductible. Only 22% know they don’t.

But here’s the good part: for people on high-cost meds, the out-of-pocket maximum is a lifesaver. One person on PatientsLikeMe shared: "My insulin copays were $15 each. I paid over $8,500 in copays last year. When I hit my out-of-pocket max, my insulin was free for the rest of the year. I didn’t know that was possible until I got there."

What you need to do right now

You don’t need to be an expert. But you do need to check your plan documents. Here’s how:

- Find your Summary of Benefits and Coverage (SBC). This is the standardized form your insurer must give you before you enroll. Look for the "Cost-Sharing" section.

- Find the row for "Generic Prescription Drugs." Look at the column labeled "Does this payment count toward your deductible?"

- If it says "No," your copays don’t count toward your deductible-but they do count toward your out-of-pocket maximum.

- Check if there’s a separate "Prescription Deductible" amount. If there is, you’re paying full price until you hit that number.

Don’t rely on your pharmacy’s app or your doctor’s office. They often don’t know the details. Only the SBC and your plan’s Explanation of Coverage document are legally required to be accurate.

What’s changing in 2025 and beyond

The government is trying to fix the confusion. Starting in 2025, insurers must clearly label how prescription costs count on all plan documents. Some states are testing "integrated deductible" plans-where your prescription copays count toward your main deductible. Early results show people take their meds more often when they don’t have to juggle two deductibles.

By 2027, analysts predict 60% of major insurers will offer at least one plan where generic copays count toward the deductible. That’s because consumers are fed up. But insurers worry it’ll raise premiums by 3-5%.

For now, the system is still split. But knowing how it works gives you power. You can choose a plan that fits your needs-not one that confuses you.

What happens if you hit your out-of-pocket maximum?

Once you hit it, your insurance pays 100% of all covered services for the rest of the year. That includes doctor visits, hospital stays, lab tests, and prescriptions-even if you still haven’t met your deductible.

Example: Your deductible is $3,000. Your out-of-pocket maximum is $7,500. You’ve paid $5,000 in generic copays this year. You haven’t met your deductible. But you’ve paid $2,500 toward your out-of-pocket max. You get into a car accident and need surgery that costs $15,000. Your insurance pays $15,000. You pay $0. Because you already hit your max.

That’s the safety net the ACA created. But only if you know it exists.

Bottom line: Know your plan, don’t guess

Generic copays are a small cost each time-but they add up fast. And if you think they’re helping you meet your deductible, you’re setting yourself up for a surprise bill later. The out-of-pocket maximum is your real shield against big expenses. Your deductible? It’s just the first hurdle.

Take 15 minutes this week. Pull up your SBC. Find the prescription section. Read the fine print. Ask your insurer: "Do my generic copays count toward my deductible?" Write down the answer.

You’ll save more than money. You’ll save stress.

Sonal Guha

January 11, 2026 AT 21:33Lawrence Jung

January 12, 2026 AT 00:15Alice Elanora Shepherd

January 12, 2026 AT 23:59Konika Choudhury

January 14, 2026 AT 03:33Darryl Perry

January 15, 2026 AT 06:25Windie Wilson

January 15, 2026 AT 07:59Amanda Eichstaedt

January 15, 2026 AT 13:12jordan shiyangeni

January 17, 2026 AT 09:53Abner San Diego

January 18, 2026 AT 22:25Eileen Reilly

January 19, 2026 AT 10:56Monica Puglia

January 20, 2026 AT 23:52steve ker

January 21, 2026 AT 22:32